On this page

Overlay

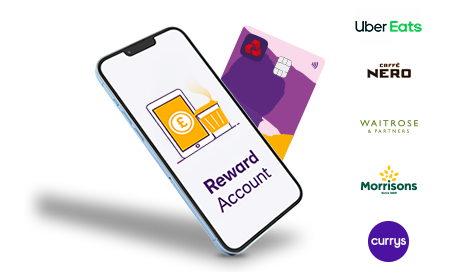

How to exchange your Rewards

You can see your MyRewards balance and exchange straight from the NatWest app with the touch of a button. You don’t need to use a password.

Just keep in mind that if you choose to bank your Rewards, they’ll take 5 working days to clear.

Other features and benefits

Switch to NatWest

Why not switch your current account to NatWest, we'll do all the hard work for you and you'll barely need to lift a finger.

Now please take a look at the important legal stuff

Information Message

If you carry on applying, it means you're happy with what's in these documents, including the FSCS information sheet. And happy to view your statements in Online Banking - not posted. Please take some time to review, print and/or save the important information.