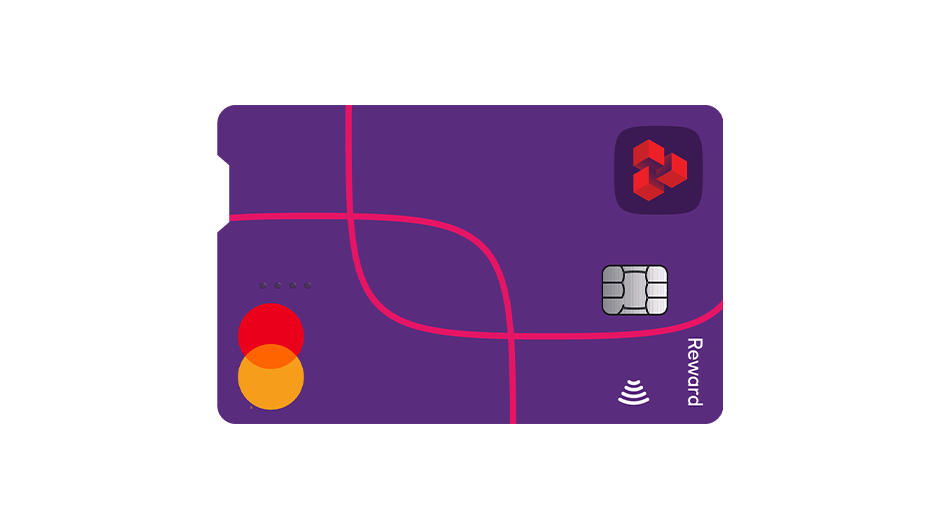

Gain Rewards every time you spend

- Earn 1% back in Rewards on supermarket spending (0.25% at supermarket petrol stations and everywhere else).

- Get 1-15% back at chosen MyRewards retailers.

- Annual fee refunded if you have a Reward current account.

It's a good idea to pay off your credit card balance every month, or you could pay more in interest than you earn in Rewards. If you transfer a balance (move debt) onto your Reward credit card, we'll charge you interest on it. Not sure this card is for you? See all our credit cards.

To apply, you must be a UK resident, aged 18+ and earn £10k+ each year.

Representative Example

Representative APR (variable):

31.0% (variable)

Assumed credit limit:

£1,200

Purchase rate:

25.9% p.a. (variable)

Annual fee:

£24 (Or £0 if you have a Reward current account.)

Your actual credit limit and APR may vary depending on our credit assessment of you. You may receive higher than our standard purchase and balance transfer rate of 25.9% (variable) on application – up to 29.9% p.a. (variable). Interest on fees and charges is payable in line with our terms and conditions. For more details, see the Summary Box.

Gain Rewards every time you spend

- Earn 1% back in Rewards on supermarket spending (0.25% at supermarket petrol stations and everywhere else).

- Get 1-15% back at chosen MyRewards retailers.

- Annual fee refunded if you have a Reward current account.

It's a good idea to pay off your credit card balance every month, or you could pay more in interest than you earn in Rewards. If you transfer a balance (move debt) onto your Reward credit card, we'll charge you interest on it. Not sure this card is for you? See all our credit cards.

To apply, you must be a UK resident, aged 18+ and earn £10k+ each year.

Representative Example

Representative APR (variable):

31.0% (variable)

Assumed credit limit:

£1,200

Purchase rate:

25.9% p.a. (variable)

Annual fee:

£24 (Or £0 if you have a Reward current account.)

Your actual credit limit and APR may vary depending on our credit assessment of you. You may receive higher than our standard purchase and balance transfer rate of 25.9% (variable) on application – up to 29.9% p.a. (variable). Interest on fees and charges is payable in line with our terms and conditions. For more details, see the Summary Box.

Check your eligibility. (Won't harm your credit score.)

Find out if we'll say 'yes' before you apply

It takes less than 10 minutes and won't affect your credit score.

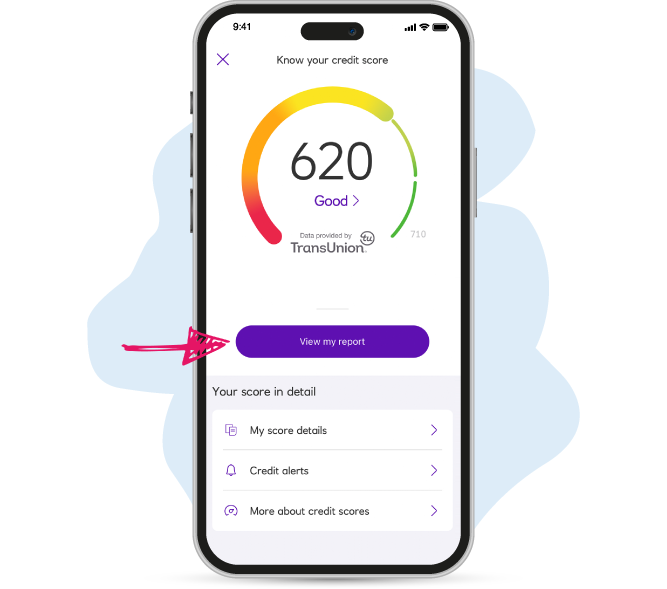

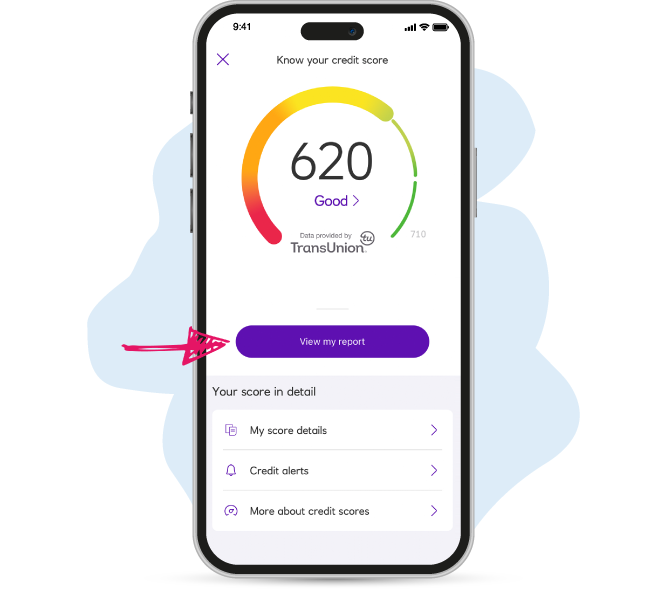

Get a free credit score, and more

Get a free credit score in our app

Plus tips to improve your credit score

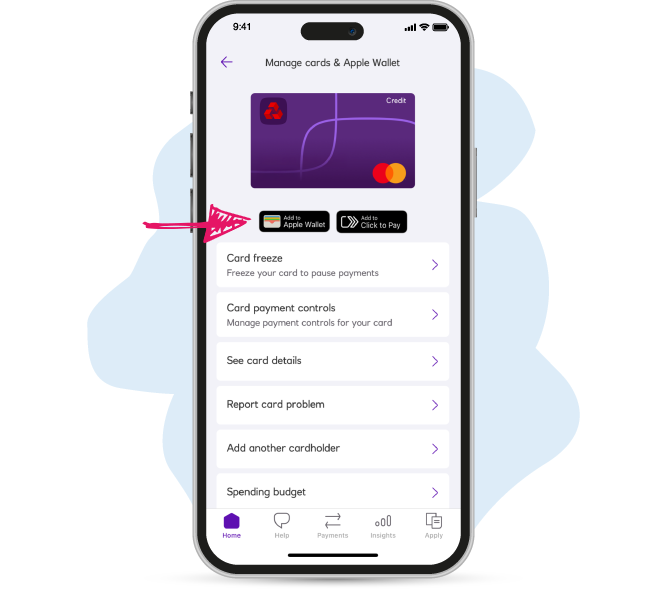

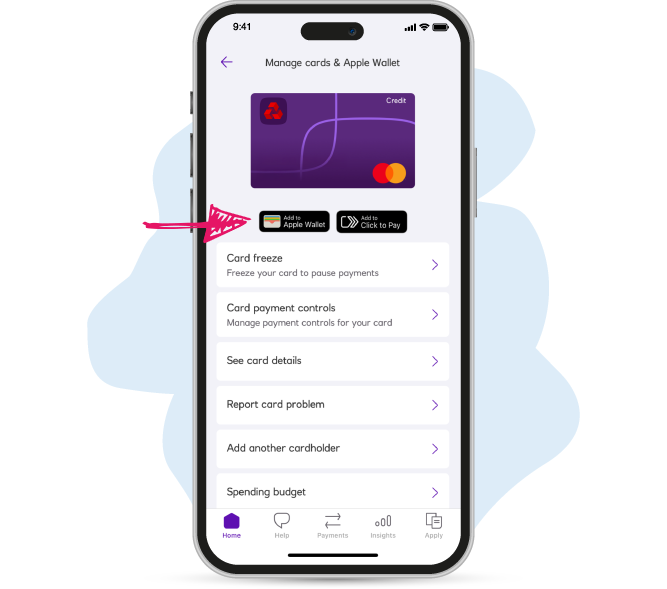

Pay with Apple Pay or Google Pay™

It's easy, safe and quick

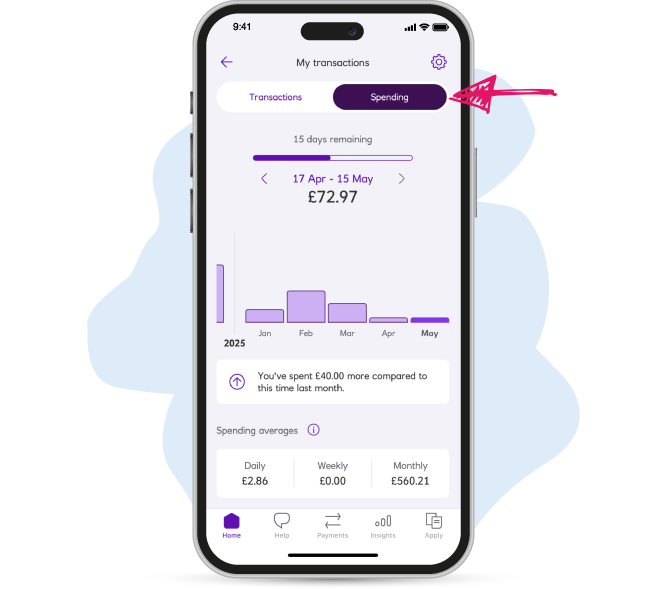

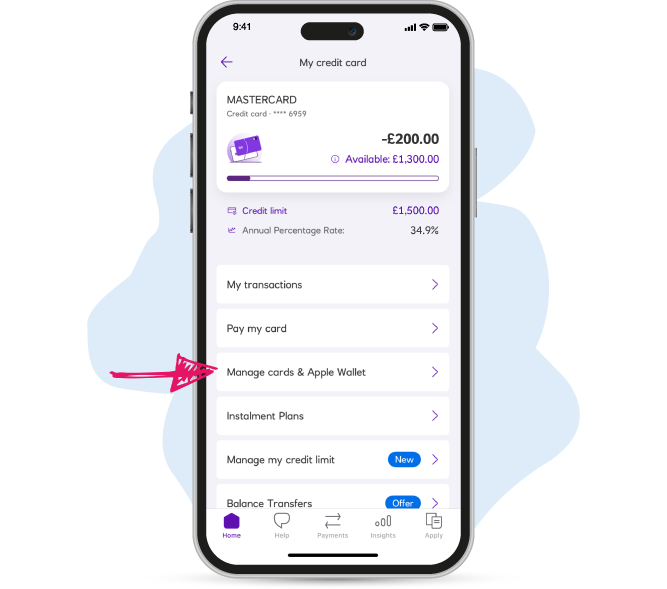

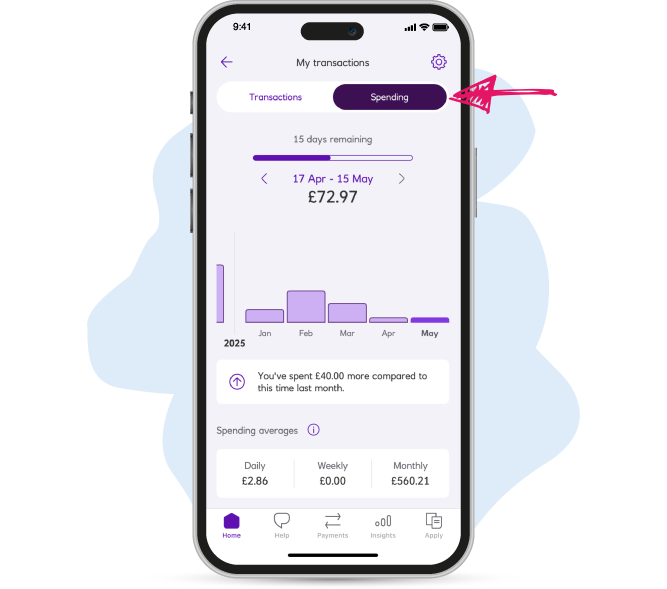

Use our quick and simple app

See your PIN, replace a card, and more

Manage your card in the app

Plus, get spending alerts

Make shopping rewarding...

Earn 5 Rewards (worth £5) and then it's up to you. Will you bank them? Exchange them for an e-card? Or donate them?

For all the juicy details about Rewards, partner offers and more, visit MyRewards.

Ready to apply? Okay, let's start by checking your eligibility...

Please take your time to read this page and decide if this card is right for you. Unsure? Try our borrowing options tool.

We'll start by checking your eligibility – this won't hurt your credit score

At the start of your application, we'll say if you could get this card and what it could cost you. It’s then up to you if you want to go ahead.

To apply for a credit card, you must:

- Be 18+, live in the UK and earn 10k+ each year.

- Not have been bankrupt in the last 6 years. (Got a joint account? They must not have been bankrupt in the last 6 years either.)

All good? Here's a bit more info: