On this page

Our App is available to customers aged 11+ using compatible iOS and Android devices. You'll need a UK or international mobile number in specific countries.

Fingerprint and facial recognition are available on selected devices.

Our App is available to customers aged 11+ using compatible iOS and Android devices. You'll need a UK or international mobile number in specific countries.

Budget calculator

Budgeting can be difficult, especially if your income and outgoings are different every month. Our budget calculator helps you keep on track: tell us what your goal is and add your income and outgoings.

We'll give you a breakdown of your finances and provide some great tips and support that could help get you towards where you want to be. We ask you for some details as you go through the budgeting tool, however none of this data is ever saved.

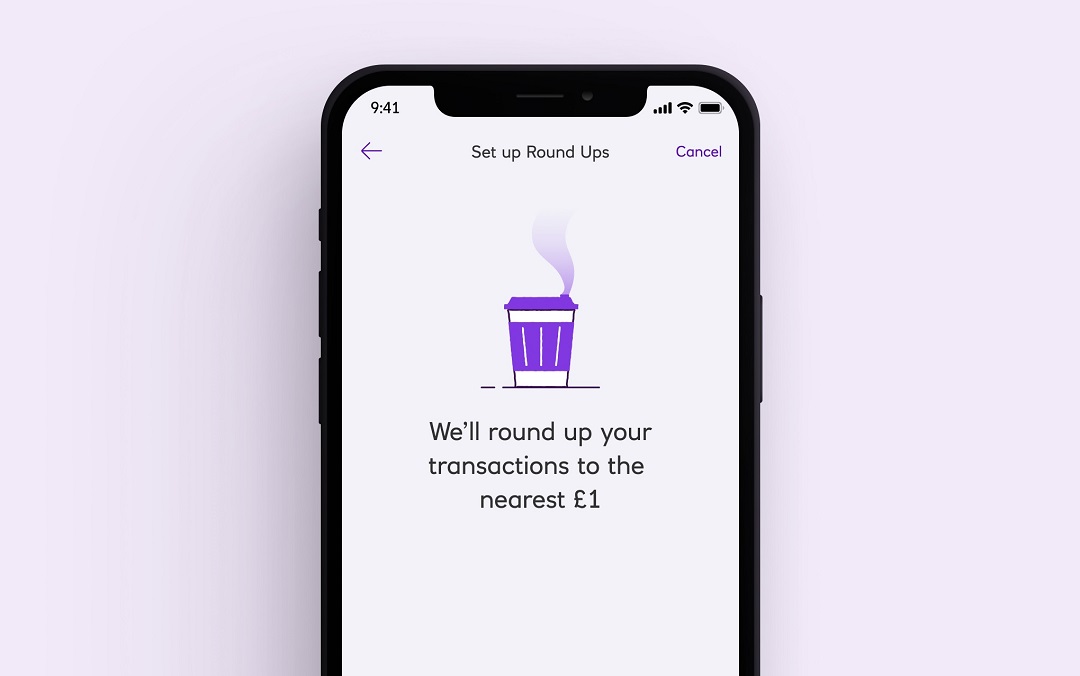

Round Ups

If you’re finding it hard to save money right now, Round Ups could make it a little easier. Every time you buy something on your NatWest debit card or contactless device, we’ll round it up to the nearest pound and send the spare change to your savings account. For example, say you buy a coffee for £2.30 – Round Ups will put away 70p for you. It’s a brilliant way to save without even thinking about it!

Round Ups is available to customers who have an eligible current account, an eligible instant access savings account and are registered for the NatWest Mobile App. Round Ups can only be made on debit card and contactless payments in Sterling.

Our App can be used on compatible iOS and Android devices. You'll need a UK or international mobile number in specific countries. Spending Tracker is available to customers aged 16+ who have a Personal or Premier account with us.

Video banking calls may be recorded and service hours may apply. You’ll need a device that has a camera or webcam, and a connection to the Internet.

Financial scams are on the rise – here's what to look out for

We spoke to a fraud prevention team about ways to protect yourself from being scammed and common scams to look out for.

Saving for Christmas? This tip could help you meet your target

Learn how one savings method could help you put cash away for big life events and meet your money goals faster.

This content is for information purposes only and shouldn’t be regarded as financial advice. While we’ve taken every effort to make sure this information is as accurate as possible, it has not been independently verified.