The ‘Support’ button is toward the top right on every Bankline page. From here you can access our library of Bankline FAQs.

Log in and start using Bankline

To activate your smartcard and log in for the first time, follow the instructions in our support guide:

You can also refer to the resources below. If you need any help click the chat button on the log in page. Cora will answer your questions and help you get logged in.

Always start from www.natwest.com/bankline, when logging in and go to the login page from there.

Don’t confuse your smartcard PIN with the Log in PIN you’ll create at first log in. The smartcard PIN is just for using with your smartcard.

Once you put in your Customer ID and User ID, you can find log in steps on the drop-down on the next screen.

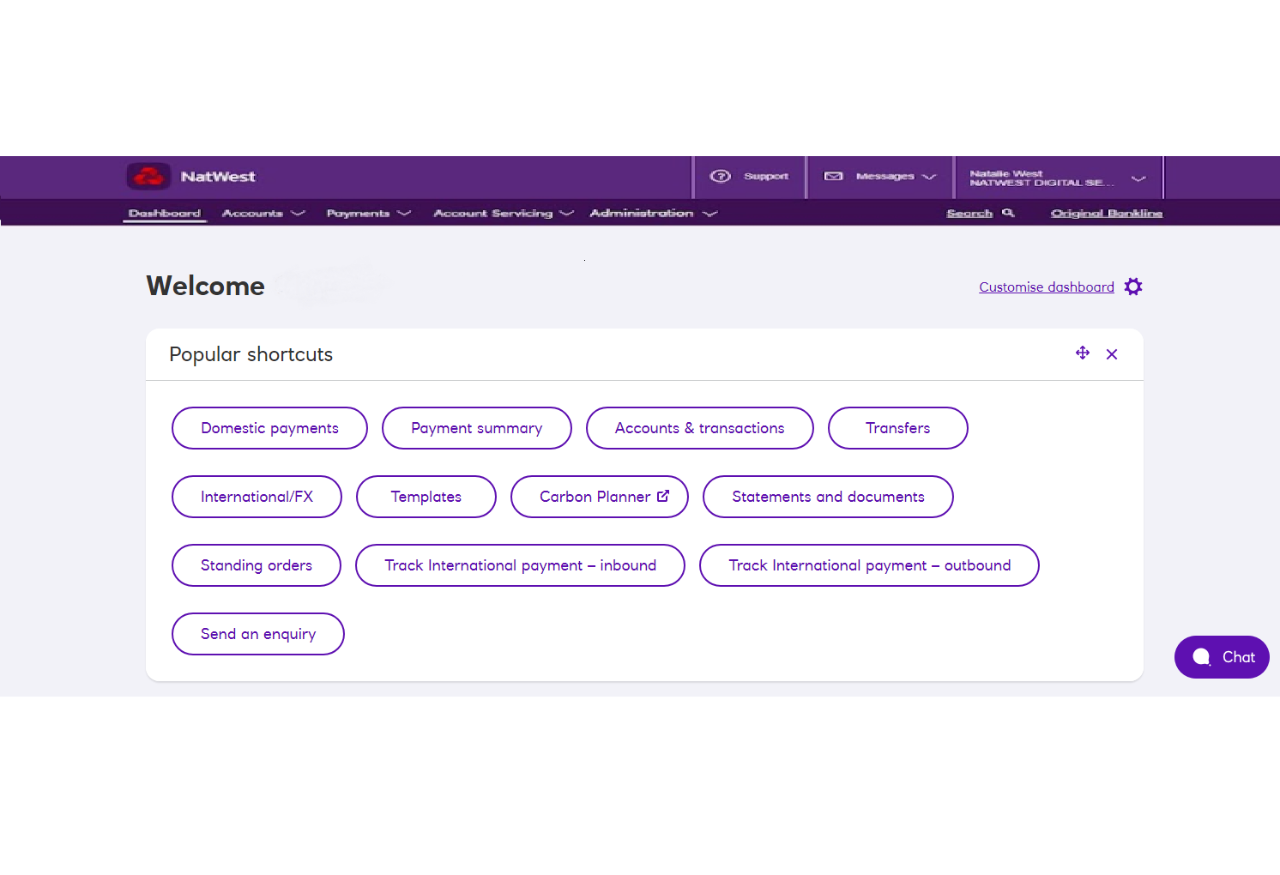

Once you’re logged in, you’ll land on the dashboard.

Think of this as your home page. From here you can access key parts of Bankline. You can also customise your dashboard to suit you:

While you’re getting settled, it’s worth us pointing out two things:

The ‘Support’ button is toward the top right on every Bankline page. From here you can access our library of Bankline FAQs.

The ‘Chat now’ button pops up toward the bottom right of each page. Click this to chat to us anytime. Cora can answer your queries and connect you to a Bankline specialist (in working hours). Once you start a chat, you can move the location of the chat box.

If you’re using Bankline Mobile, instead of approving payments with your smartcard, you can complete the approval step by using your phone’s biometric functions (if your phone has these features). In other words, you can use facial recognition or your fingerprint to approve the payment.

Bankline Mobile is available to Bankline customers on selected iOS and Android devices with a UK or international mobile number in selected countries. It’s free to use and download, but standard payments fees still apply.

Also referred to as inter account transfers or IATs. This is a way of transferring funds in sterling or foreign currency between your registered accounts in Bankline.

Usually, you’ll be able to see and use the transferred funds immediately.

A CHAPS payment is a way of moving money between UK sterling accounts, with funds arriving cleared on the same working day.

CHAPS can be used for payments of any amount, but are commonly used for payments over £1 million. Payments under £1 million can be made as Faster Payments (standard domestic), which are cheaper to send.

CHAPS payments are also suitable when you need to include a reference for the payee of more than 18 characters. They can be sent Monday to Friday (excluding public holidays) and usually have a cut off time of 5.30pm.

Standing orders are recurring payments you can set up that are then made automatically for as long as the standing instruction apply.

To set up or edit a standing order for one of your accounts, there’s a separate online form to complete, which you can access via Bankline.

Templates let you create and save payee details for future use when making payments. Useful if you have regular payees. They offer more flexibility than bulk lists, as you can set a maximum amount that can be sent. You can also create templates for domestic and international payments and transfers between your accounts.

If you’re using Bankline Mobile, instead of approving payments with your smartcard, you can complete the approval step by using your phone’s biometric functions (if your phone has these features). In other words, you can use facial recognition or your fingerprint to approve the payment.

Bankline Mobile is available to Bankline customers on selected iOS and Android devices with a UK or international mobile number in selected countries. It’s free to use and download, but standard payments fees still apply.

For high volumes of payments (payroll payments for example) one time-saving option is to import them to Bankline in a file, they can then be reviewed and approved as a group.

We support most common file types.

Your organisation should have processes in place to ensure you check the validity of all payment requests. This can include:

If your organisation has two or more people involved in making a payment, be aware of your responsibilities and don’t rely on anyone else involved in the process to make the relevant checks.

Keep up to date on current fraud threats by visiting the security centre, attending our fraud awareness webinars, and reading any on screen messages and alerts.

For a full run through of your payment options and tips for making things efficient and secure, join a Bankline payments webinar.

These resources will help you when you come to raising and approving all kinds of payments:

We hope you’ll feel at home in Bankline in no time.

In Step 3, we’ll cover tips for getting the very best from Bankline and resources for future success.